Similarly, the number of new licenses issued has also grown at a momentous pace.

Market Share

Total

beer market of Sri Lanka can be estimated at around LKR34.4 billion.

The Players

Asia Pacific

Brewery (Lanka) Ltd

APBL is

60% owned by Singapore-based Asia Pacific Breweries Ltd. The rest of the

holding is held in partnership with Sri Lankan-based Anandappa family group and

MBL Offshore Limited, wholly-owned subsidiary of Phoenix Beverages Limited,

which is a leading beverage group from Mauritius.

APBL

offers the Anchor, ABC Stout, Baron's Strong Brew and local beer brand Bison

Super Strong in Sri Lanka.They also offer Heineken brands in Sri Lanka as well.

Millers Brewery Ltd

MBL came

under Sri Lankan conglomerate Cargills (Ceylon) PLC with the acquisition of the

renownedMcCallum Brewery Limited through fullyowned subsidiary Millers Brewery

Limited.MBL offers the famous brands ‘Three Coins’, ‘Irish Dark’, ‘Sando’ and

‘Grand Blonde’ etc.

Lion Brewery (Ceylon)

PLC

LBL is a subsidiary of Ceylon Beverage Holding

PLC which is part of diversified group called CarsonsCumberbatch PLC. Both LBL

and its parent companies are listed on the Colombo Stock Exchange (CSE). The group

structure of the company is given below.

Acquisition of

competition

In a

recent acquisition of MBL by LBL,

the industry was consolidated by LBL by effectively regaining the lost market

share.As per the public announcement; the purchase consideration paid by LBL

was LKR 5.15 billion (without debt).

Post-acquisition

price movement

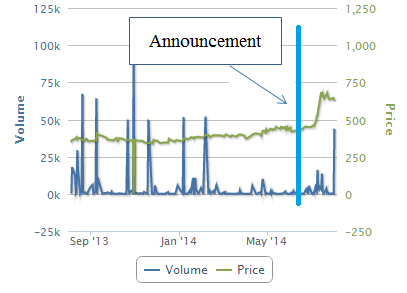

The

public announcement of the proposed acquisition was made on the 20 June 2014. With

the announcement, the price of LBL went up significantly with the investors

factoring in the impact of the acquisition. Interestingly, not only did

LBL move up; so did the parent company and the ultimate parent Bukit Darah

PLC.

The

total market capitalization of LBL pre-acquisition was LKR 34.4 billion (on 18

June 2014) and at the close of business on 20 June 2014 it was at LKR 35.512

billion, just up by LKR 1.112 billion. The increase was just 22% of the

acquisition price paid (or suggested). However, the momentum continued and by

14 July 2014, LBL was valued in the market at LKR 54.736 billion adding a

staggering LKR 20.336 billion to the pre-acquisition market cap (which is

almost 4 times as much as the price paid!). As of my writing, the company is

valued at LKR48.6 billion, at a share price of LKR 607.60. Had the market

factored the exact value the Company paid to buy MBL, the market cap would have

been at LKR 39.55 billion with a per share value of LKR 494.38.

Was it value

accretive or dilutive?

Well,

that depends. Not that every acquisition is necessarily value accretive or vice

versa. For instance, there are enough examples of disastrous acquisitions done

by some very well-known companies. If you could remember, HP’s acquisition of

Autonomy for $11 billion and subsequent write off of $8.8 billion is a classic

recent example of a dreadful acquisition. In the beer industry, one noticeable

recent acquisition was Heineken’s $24 bn acquisition of Asia Pacific Breweries

completed in 2012.

In the

case of acquisition of MBL by LBL, lack of public information (given that

MBL is a private entity) makes it difficult to suitably look at the accretive/dilutive

impact on the acquirer. The acquiring firm also did not mention the exact

motives behind the acquisition, though it was only clear that it’s an effort to

gain market share by eliminating the 3rd largest player in the

market. The chairman, however in his discussion, mentioned in the Annual report that they look to

enhance volumes and profitability via the acquisition. As per available

numbers, this acquisition would potentially lead the beer industry in Sri Lanka

to a Herfindahl-Herschman Index (HHI) number of 8,117 from current 5,942,

signifying even more industry concentration. (yet more concentrated than the

2009 index of 7,094; note that an index number closer to zero signifies perfect

competition while 10,000 is indicative of a monopoly). Interestingly, Sri Lanka

does not have anti-trust law that would prohibit LBL from creating a beer

monopoly in the future and that this acquisition, in my opinion, has laid the

foundation for the creation of a beer monopoly in Sri Lanka. That is good news

for the shareholders.

Whether

there was an intention to cut costs, enter attractive new markets, etc is not

known yet. Even if the intention was not there, if they were not able to

achieve these synergies; post-acquisition there is massive potential for this

acquisition to be value destroying. Without an idea on the cost structures and

margins at MBL, I’m unable to gauge the impact of the acquisition on LBL’s

earnings. I would only assume that LBL will be able to maintain the same operating

performance at MBL level post-merger as well. In that light, I believe that the

acquisition of MBL would generate them return on capital in excess of the cost

of debt for the deal. (My belief is that the acquisition was funded by LBL with

debt as evidenced by the increased borrowings on the balance sheet, see tables below of the debt position and cash position) Over the

last five years, LBL has on average generated return on equity of c.21.4% which

is in excess of cost of debt for LBL which is currently rated AA- by FitchRatings.

Moreover, I believe that post-merger; LBL will enjoy a market share of c.86% (or more) which should enable them to be more profitable.

Pricing the deal

Cargills (Ceylon) PLC interim financials for the period ended 31 March 2014

reveals that the beverage segment was not contributing towards the

profitability of the Group. Hence, I assume that there is no meaning in looking

at the trailing PE to evaluate the deal pricing. However, looking at the market

share data I tried to approximate the topline of MBL. Based on data I estimate

their revenues to be c. LKR3.859 billion. At an acquisition price of LKR 5.15

billion the deal is priced at 1.3 times a Price to Sales multiple. This was

exactly equivalent to the P/S multiple LBL was trading at on 18th June 2014. (based on trailing revenue of LBL).

Also

based on the available data, the deal is valued at P/B of 2.56x. Comparably,

LBL was trading at 4.96x price to book at 18th June 2014.

I also

deconstructed the purchase consideration as follows.

Since,

LBL bought a private entity the pricing seems to be not as high as it would

have been for a public company acquisition, in which case normally the buyers have to pay a

premium over the market price. Further, the market prices would also move up

before the acquisition due to market rumors and that might lead to potential

over-payment in a market transaction. My belief is that the above approximate

pricing metrics also suggests this verity.

Value of the combined entity

I have also done a valuation of the combined entity in order to see its valuation based on the DCF method.Bottomline

Overall I believe that market has so far over reacted to the acquisition and based on my valuation LBL is currently over-priced by around 17%. In terms of the acquisition, it makes sense for them to acquire competition which should allow them to be cost efficient, grow faster, compete stronger, etc. Moreover, the acquisition has been made at the right time when the industry is growing fast. However, regulatory risks, operational risks at MBL level would be significant risks to watch for.

Keep it up bro.

ReplyDeleteIs really informative.

Thanks Ginisiluwa for the comment. I will try to do my best subject to availability of some leisure time to write. Hope you will enjoy reading the rest of the articles as well. Welcome your thoughts good or bad, on them as well.

ReplyDeleteEnjoy writing these and adding some value to the Lankan Markets.